How to Read a Check

I know what you're thinking... who uses checks anymore? Since you're not required to fill out a check at the store to purchase items or send in a check to pay for rent or monthly mortgage anymore, why are personal checks still important?

But, knowing how to read a check is still a good skill to have plus checks are still widely used. Today, checks are an additional option used to pay for gifts, transfer money, or pay a bill. In case you're at a business that doesn't accept cash payments, you can write out a check instead of having to carry large amounts of cash with you. (Not to mention, checks are a safer option than cash!)

But, knowing how to read a check is still a good skill to have plus checks are still widely used. Today, checks are an additional option used to pay for gifts, transfer money, or pay a bill. In case you're at a business that doesn't accept cash payments, you can write out a check instead of having to carry large amounts of cash with you. (Not to mention, checks are a safer option than cash!)

So... if you're thinking about using a check or just need a refresher, here's how to write and read a check. I'll also share some best practices used when handling a physical check so you're in the know.

here's what we'll cover

|

|

what is a check?

When someone writes a check, they are essentially creating a legal document that promises to pay the amount of money written on the check from their checking account. The check is then given to the recipient, who can take it to their bank and exchange it for cash. If the recipient does not have a checking account, they can still cash the check by paying a small fee. Checks are a convenient way to pay for goods and services, and they are also a relatively safe form of payment since they can be canceled if they are lost or stolen.

what is a check used for?

Checks are typically used for one-time payments, such as:

- Utility bills

- Rent

- Grocery shopping

- Paying money to friends or family (the old-school version of Venmo!)

When you write a check, you need to have enough money in your checking account to cover the amount of the check plus any fees that may apply. Once you write and sign a check, it becomes legal tender, which means that the recipient can use it to pay their own debts or expenses.

Some advantages of using checks instead of cash or credit cards include:

- Checks leave a paper trail that can be helpful for tracking expenses.

- Checks can be more secure than cash since they can be canceled if they are lost or stolen.

- Some businesses may offer discounts for paying with a check instead of cash or credit.

Overall, checks can be a convenient and affordable way to make payments, as long as you have the funds available in your checking account.

how to fill out a check?

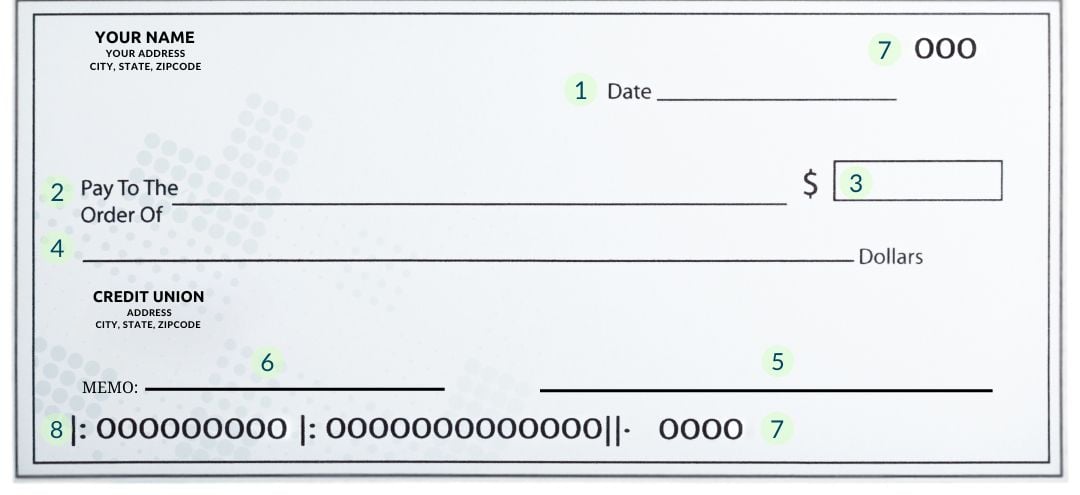

Using the following images, here's how to properly read and fill out a check.

*This image is for demonstrative purposes only

1. DATE

Write out the current or today's date in this section. This tells the recipient when the check was written and when they can expect the funds to be available. The date also helps to ensure that the check doesn't get lost or forgotten about. Including the date also makes it easier to track your spending and reconcile your bank statement.

2. PAY TO THE ORDER OF/ PAYEE

Write out who you're paying the check - this can be an organization or a person. Make sure this part of the check is accurate and if you're not sure, it's ok to ask "who should I make the check out to?"

Psst… it’s important this matches the name of the account holder where the money will be deposited.

3. DOLLAR AMOUNT IN NUMBER FORM

Write out exactly how much you're paying in numeric form. If your payment is twenty-eight dollars and thirty-eight cents, make sure you write out - $28.38.

4. DOLLAR AMOUNT IN WORD FORM

Here you'll do the complete opposite of section 3... You're going to write out your payment in word form. make sure you write it all out - twenty-eight dollars and thirty-eight cents. This will help with any confusion especially in regards to fraud.

QUICK TIP: To help avoid any fraud, write out your payment amount in capital letters. This will make it harder for any fraudster to alter your check. |

5. SIGNATURE LINE

This is an important part of the check.

On the bottom right line of the check, sign your name. This must be the same name and signature that's on file at your financial institution. The check will not be valid if the signature line is blank.

Psst… only sign the check once you’ve completed the rest of the check. If you sign the check before filling in the dollar amount or payee and change your mind, that check can still be used and cashed by fraudsters.

6. MEMO (FOR) SECTION

The memo line is simply optional. This part allows you to briefly describe or place a reminder about why you wrote the check. If you were paying a utility bill with a check, you can place your account number on the memo line. For example, if you were paying your rent with a check, you can write "November 2022 rent".

QUICK TIP: If you’re paying a bill, make sure to check the invoice! Some vendors ask that you write your invoice or account number in the memo line so they know to credit the right account. |

7. THE CHECK NUMBER

A check number is a reference number that is typically printed in the bottom right corner of a check. It's also located on the top right of the check. This number is used to help keep track of your checkbook and to prevent duplicate payments.

When you write a check, if it's not already listed, write the check number in the top right corner of the check. This will help you keep track of which checks have been paid and which ones have not. If you ever need to cancel a check, you can do so by referencing the check number.

8. ROUTING & ACCOUNT NUMBERS

You'll find these numbers directly under the memo line.

- Routing number: A routing number is a 9-digit code that is used to identify a financial institution in the United States. Routing numbers are also sometimes referred to as ABA routing numbers or bank routing numbers. The code is used to facilitate the electronic routing of funds (ACH transfers) from one bank account to another. Most banks will have the same routing number for all of their branches, but there are some exceptions.

- Account number: The account number is the eight to twelve digits that identify the account holder's bank and checking account. These numbers are printed on the bottom of the check, usually to the right of the routing number. The account number is used by the check processing center to route the check to the correct bank and account. The account number will be clearly labeled. Psst... It is also useful to have on hand in case you lose your checkbook or have a question about a particular check.

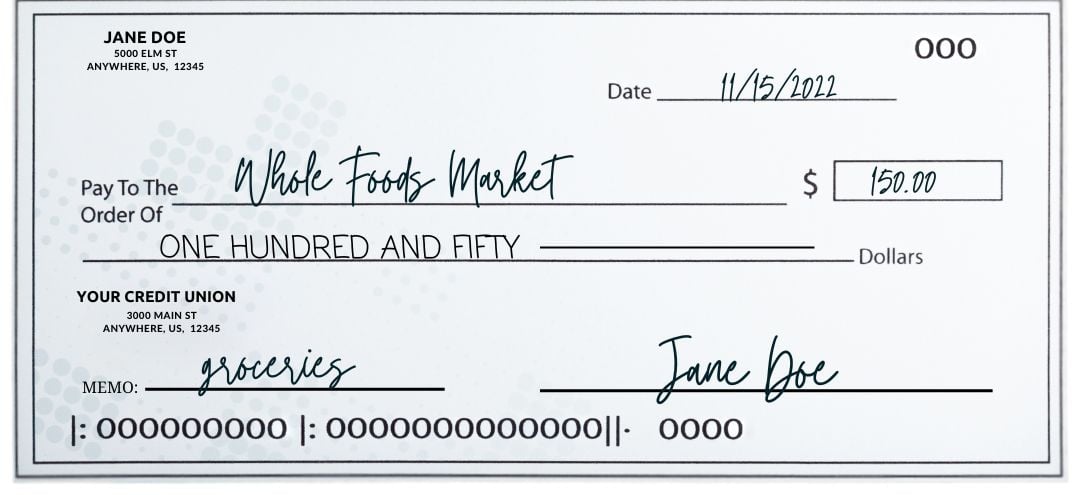

Here's what the check should look like when it's completed.

*This image is for demonstrative purposes only

what's on the back of the check

You'll notice the text "Endorse Here" on the back of a check. As the receiver of a check, you need to sign your name in order for the check to be cashable.

.jpg?width=647&height=297&name=how%20to%20read%20a%20check%20(1).jpg)

*This image is for demonstrative purposes only

what to do after you write the check?

Grab your checkbook register and notate the transaction you just made!

A checkbook is a critical tool for managing personal finances. By keeping track of all deposits and withdrawals, it helps to ensure that spending stays within budget. This is especially important in today's age of online banking, where it can be easy to forget about small transactions.

With a balanced checkbook, individuals can get a clear picture of their financial situation and make informed decisions about spending. In addition, a checkbook can help to quickly identify any errors made by banks or businesses. Ultimately, a balanced checkbook is an essential part of responsible financial management.

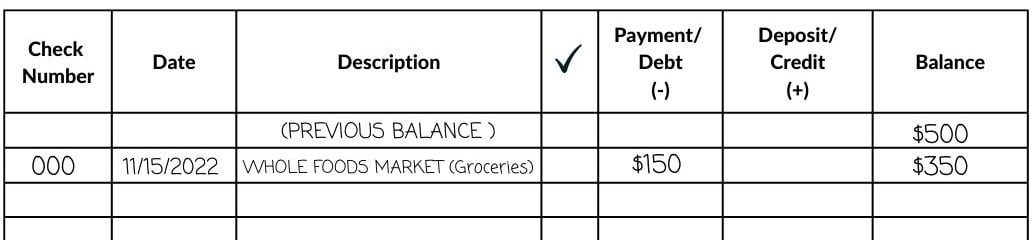

Here's an example of a check register, using the information from the check written out to Whole Food Market to complete the check register.

*This image is for demonstrative purposes only

Make sure you insert the check number, date, description of the transaction made, and the payment or deposit amount along with the balance onto the check register. You're going to copy this info so you can reference back to it later.

In the event you've made other previous transactions, your check register should list your other transactions in case the transaction has not been posted to your account yet.

Want your own check register, we have a free check register template just for you.

what are some best Practices when writing a check?

- To ensure that your check is not lost or stolen, it is important to keep track of your checkbook.

- Keep a list of all the checks you have written in your checkbook register so you can reconcile your account when your monthly statement arrives.

- Write legibly and use ink so that the check cannot be altered.

- Always date your check correctly and do not post-date it.

- The "Pay to the order of/Payee" section should also be clearly written to avoid any confusion.

- The amount of the check should be written both in numbers and words on the designated line.

- Once you have completed writing your check, sign it in the bottom right-hand corner using your normal signature. This signature should be consistent across all your checks so that businesses can confirm your identity.

- When making deposits or withdrawals from an ATM, use restrictive endorsements such as "For Deposit Only" to ensure that your check is properly handled.

- After each transaction involving a check, update your records and destroy any voided or unused checks for security purposes.

WHAT IF I MESSED UP SOMETHING ON THE CHECK?

- If you make a mistake on the check, draw a line through the error and initial it so that it cannot be changed. You should then write VOID across the face of the check and tear it up.

- If you accidentally write a check for more than you intended, void the entire check and write a new one for the correct amount.

- Just like when you get a new debit or credit card, make sure to cut up the check into small pieces before throwing it away.

HOW LONG SHOULD I HOLD ON TO A CHECK?

Unlike depositing a check at the teller line, you’ll still have the check on hand if you use Mobile Banking. A good rule of thumb is to keep the check for 7 – 10 days after depositing to ensure the funds went into your account. Make sure you store the check in a safe space since it has important financial information about the check writer.

By following these simple steps, you can help prevent fraud and safeguard your finances.

ready to balance your checking account?

Have you ever heard of balancing your checkbook? This is absolutely the same thing, we're just referring to it as your checking account!

Balancing your checking account gives you the ability to quickly catch anything wrong with your money. You would know the date, the amount, and probably the merchant that took the amount if fraud were to occur. What do you have to lose? You'll know how to manage your checking account responsibly.

If you need further assistance, our Customer Service Representatives are here for you here and ready to assist! You can get in touch with us here, call us at 704.375.0183, or visit any of our branches.

As Content Strategist behind the Learning & Guidance Center, Yanna loves showing just how doable finance can be. Whether it’s simple tips, step-by-step guides, or comparison charts, she’s passionate about helping readers take charge and reach financial freedom with confidence

more resources for your financial journey

How to Balance Your Checking Account

Balancing your checking account is not hard. It's a great way to track spending and avoid fees. Here are the steps that will get your account balanced.

9 min. read

How Much Money Should I Keep In My Checking Account?

Don't know the amount you need to keep your checking account in good shape? Different checking account fees can mess that up. Here's an amount that'll help.

10 min. read

ways to avoid checking account fees

ways to avoid checking account fees

Here's how to avoid those pesky fees and keep your hard-earned money where it belongs - in your pocket!

learn how to read a check

learn how to read a check

Learn how to read a physical check so you know how to keep your money safe.

learn about debit cards

learn about debit cards

A debit card can be a great way to access your money but do you know the risks and benefits when using one?