How To Get Out of Credit Card Debt

.png)

Credit card debt just sucks - plain as that!

It’s easy to see a credit card as “free money,” and use it to make purchases you couldn’t otherwise make. The problem is, when the billing cycle ends and it’s time to pay back what you borrowed, it can often be more than you can afford. And if you miss a payment, you’ll risk facing an increase in your interest rate and paying additional fees!

It’s easy to see a credit card as “free money,” and use it to make purchases you couldn’t otherwise make. The problem is, when the billing cycle ends and it’s time to pay back what you borrowed, it can often be more than you can afford. And if you miss a payment, you’ll risk facing an increase in your interest rate and paying additional fees!

Ultimately credit card debt can add up and look bad on your credit report where your score gets impacted. So, it’s completely understandable that you’re looking for answers. But don't worry, there are ways of getting out.

Did you know the Federal Reserve Bank of New York recently released in their 2022 consumer data report, credit card debt reached $841 billion in the first three months? YIKES! |

As you can see, you’re not alone here! Here are some effective and actionable steps to take to help you TACKLE your credit card debt!

You should feel empowered and equipped with tips for paying off debt, and we’re here to help.

here’s a look at what we’re about to cover

|

how do i get rid of credit card debt on my own?

how do i get rid of credit card debt on my own?

My father would always say “Debt ain’t no joke” each time he paid his bills. To get rid of credit card debt, it'll certainly help to have an action plan in place so there's a clear direction of what you have set out to do when eliminating debt. Here’s where you can start.

step 1. freeze your card

step 1. freeze your card

The first thing you should do when starting to plan your debt strategy is to stop adding to it! If possible, you should freeze your card either literally (by putting your card in a Tupperware of water into the freezer) or figuratively (by freezing it online so it’s temporarily un-usable).

If you must use your credit card, make sure you’re only using it for necessities like groceries and gas. The more you use your card, the deeper the hole you’re digging.

step 2. get to know your debts

step 2. get to know your debts

It's easy to say "in six months I'll have all of my credit card bills paid off" without setting the proper steps in place to make the plan happen. Here’s what'll help you focus and gain control when getting rid of your credit card debt.

ADD UP YOUR DEBTS

Whether your credit card debt is $1,000, $80,000, or more, knowing how much debt you owe creditors will help you get your mind ready when paying off lenders so you're not approaching this process blindly.

DETERMINE YOUR MONTHLY EXPENSES

Now that you know how much you owe, it's time to list your income and all your monthly expenses (not just your credit card debt). This includes utility bills, gym memberships, app subscriptions (Netflix, HBO Max, Hulu, Pandora / Spotify), and a little extra for dining out. You need to make sure you’re making room to pay off other expenses you’re responsible for.

It’s important to review and revise your financial plan often because your financial needs and situations are always evolving.

FIND THE WIGGLE ROOM

Now that you have a good idea of what you spend each month, you can see how much extra income you must put towards paying off your debts. If you have debt on a credit card, try to find alternative ways to spend money without adding any additional balance onto your card during this process. But don’t spend too much, we want to avoid impulsive buying at all costs.

step 3. choose a paydown strategy that works for you

step 3. choose a paydown strategy that works for you

To begin your pay-down plan, it's time to choose a debt paydown strategy. There are two most common methods when it comes to paying down debt – the Snowball Method and the Avalanche Method. As I mentioned in a previous article, 7 Steps to Paying Down Debt, there will be people who swear by one method over the other, so take a look at the strategies for each and decide for yourself which one you can really do that fits within your means

Snowball

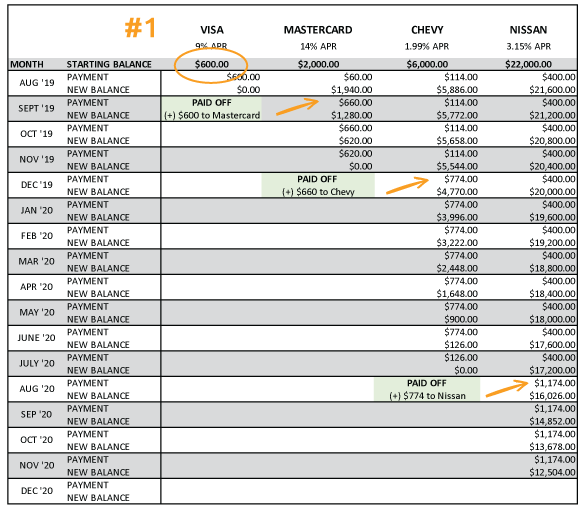

This is where you make the minimum monthly payment on all debts and contribute as much extra income as you can to the smallest debt first. Once you pay off the smallest debt, you take the total you were contributing and put it towards the next smallest.

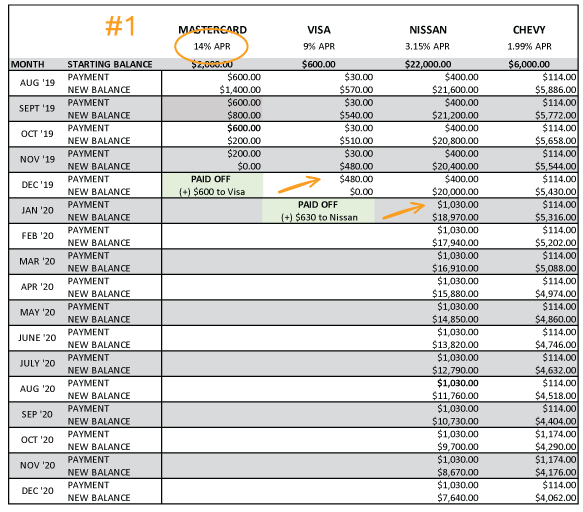

Avalanche

The avalanche method is where you put the extra payments towards the debt with the highest interest rate. Once you pay off the highest, you move to the next highest, and so on. Paying more towards debt speeds up the debt pay-down process. This can save you some time and money during your journey.

QUICK TIP: Depending on your credit card interest rate, it may be the right time to consider a balance transfer. Balance transfers are ideal for debt consolidation and can help you pay down your debt without accruing more interest. Learn more about the right time to do a balance transfer here. |

step 4. make your plan and make it visible

step 4. make your plan and make it visible

Once you figure out your paydown plan, you need to write it down. If you’re a visual person, it’ll really help you see the progress you’re making. Plus, you can hang it up on your fridge or at your desk so it serves as a constant reminder.

QUICK TIP: If you need help determining how much time or money you need to dedicate to a debt, check out our calculators. This will help you figure out how much your monthly payment should be to pay down your debt by a certain date or how long it will take you to pay your debt down with what you can contribute now. |

Psst… now would be a great time to download the Smart Budgeting Guide to snag the free template so you can track your spending, too.

step 5. adjust and adapt

step 5. adjust and adapt

If you want this paydown plan to truly work in your favor, you need to make some changes to how you move and spend money on a regular basis. This means you need to take a break from using credit cards and convert to using cash. You can also look into cutting the expenses you don’t really need or find ways to earn some extra money on the side.

If you want this paydown plan to truly work in your favor, you need to make some changes to how you move and spend money on a regular basis. This means you need to take a break from using credit cards and convert to using cash. You can also look into cutting the expenses you don’t really need or find ways to earn some extra money on the side.

Cut down on your expenses

Since you listed out all of your monthly expenses in step 2, what can you do without?

- Are you a member of a gym? Consider free health and fitness apps like Nike Training Club

- Do you have a lot of streaming services, subscription boxes, cable TV, music services, or car insurance? Do you need them? Is there a way you can enjoy the same service but at a $0 to low cost?

- Do you buy coffee on the way to work or out running errands? Consider making coffee at home and save that extra $5 each trip – it can add up!

QUICK TIP: If you work from home or you don't drive your vehicle as much, you could trim down your car insurance cost since you're using less mileage during the year. Contact your car insurance provider and ask about how you can trim your payment down. |

Need some more ideas for how to cut down on spending? Here are 35 frugal living tips to help you save money by the Clever Girl Finance

Take a break from credit cards and use cash

A credit card break is much needed! Since the whole point is to get out of credit card debt, it wouldn't be wise to use it. Plus, using cash instead of a credit card forces you to use what you have.

If you're finding it hard to use cash instead of a credit card, don't close your credit card account, instead leave the credit card at home, freeze it or cut it up. Closing the credit card account can hurt your credit score if you're looking to maintain a healthy credit score and history.

QUICK TIP: Since your using cash, consider looking for sale coupons before you go shopping. You can save some extra dollars to put towards a bill and avoid overspending. |

get a side hustle to help pay down credit card debt

There are plenty of opportunities out there to help you make more money. You can sell your stuff, get paid to do chores for others, rent your room or entire home on sites like Airbnb, become a dog walker, and more! Check out these 44 Profitable Ideas to Make Extra Money on the Side.

what are some other options to help?

what are some other options to help?

Having a lot of credit card debt can feel extremely overwhelming, but you don’t need to go it alone. If you don’t feel like you can pay off your debt through your own budgeting skills, you have other options available.

Work with your lender

You were approved with a credit card in the first place because the lender saw you as less of a risk. They trust you'll repay them their money. If you were having trouble making payments the best thing to do is be open and honest with them. There may be a program they offer that can help you. Many lenders offer Skip-a-pay where the lender will offer more time to come up with a payment on your credit card. If you're struggling to make your next credit card payment, contact your financial institution - there may be a hardship program available.

QUICK TIP: If you're curious about Skyla's Skip-A-Pay program, it's offered on auto loans and personal loans. You can learn more about it here. |

CONSIDER Doing a balance transfer

If you have one or more than one credit card, lenders offer credit cards where the debt from previous credit cards is consolidated and transferred onto a credit card (preferably a 0% APR credit card) where you can pay off your debt and not pay the interest for a certain period of time. Many lenders offer this debt paydown solution, but it may to may not be best for every credit card holder.

QUICK TIP: Not all financial institutions charge a boat load of fees when doing a balance transfer. At Skyla, a great benefit to our balance transfer is that it's totally free! Check it out! |

CONSIDER another personal loan

Normally I would be against using another loan to pay off your credit card debt, but what if you don't have immediate cash on hand and you're looking for some peace of mind? Plus, if your credit card interest rate is super high, getting a personal loan with a lower interest rate can save you money in the long run. Using a personal loan to pay off credit card debt could mean you'll pay the original debt off in full. This is my least favorite solution.

It's important to know when it makes sense to use a personal loan to pay off credit card debt. Will you get a lower interest rate? Will you adjust your spending habits? Can you make regular payments on a personal loan? Think about this before considering another personal loan.

you've got the steps...here's what's next

Feel free to come back and use this article as a reminder to stick to your credit card debt pay-down plan. I also hope you feel more confident in kicking debt in the hams and enjoy your life stress-free. Remember, you’re not the only one who has credit card debt, and becoming debt-free doesn't happen overnight (unless you came into a large load of money like winning the lottery). It's important to stick with your paydown process and stay motivated along the way.

Want some tools that'll make your process easier? Here you go!

APPS AND BANKING SERVICES THAT'LL HELP ALONG THE WAY

- Skyla Budgeting in Online Banking: Did you know Skyla credit union has free budgeting tools for you to use in Online Banking? Learn more about building your custom budgets here.

- Rocket Money: I personally love this app. It does more than what's advertised on the website. The app reminds you of upcoming payments that’ll hit your bank account, tracks your spending, and can cancel subscriptions for you. Check it out.

- Debt Payoff Planner & Tracker: The Debt Payoff Planner is the best debt payoff overall, according to the ratings and reviews on Google Playstore (4.5 stars with 2,477 reviews). The basic version is free, but the pro-version is $24 for two years, with shorter terms available on the app. Get the app here.

- Debt Manager: This is a get-out-of-debt-fast app that's available for Apple users. It includes the snowball method, a debt summary and tracking, a progress bar, and more. Check it out here.

you deserve a freebie

you deserve a freebie

If you were awesome enough to sit through all that info, you certainly deserve a high five and some free downloadable templates to create your own payment plan. Start paying down your credit card debt and get your budgeting plans in place today with these free helpful tools. You’ll be able to:

- Create a monthly budget with income and expenses

- Design a debt payment plan that works with your timeline

- Visualize your long-term financial goals

NEED FURTHER ASSISTANCE WITH YOUR CREDIT CARD DEBT? WE'RE HAPPY TO ASSIST

If you have any questions or comments, our Customer Service Representatives are here for you. You can send an email, give us a call at 704.375.0183, or visit any of our branches.

As Content Strategist behind the Learning & Guidance Center, Yanna loves showing just how doable finance can be. Whether it’s simple tips, step-by-step guides, or comparison charts, she’s passionate about helping readers take charge and reach financial freedom with confidence

more resources for your financial journey

What Happens If You Have 0% APR Credit Cards?

Looking for a credit card that offers a zero percent interest rate. Here’s what happens and what to keep in mind when you sign up for this kind of credit card.

8 min. read

7 Steps to Paying Down Debt

Need solutions to pay down your debt and you don’t know where to start? Your answers are here with tools available so you can get started today.

13 min. read

Plan to Get Out of Credit Card Debt

Plan to Get Out of Credit Card Debt

Debt is overwhelming - I know! Here's what to do to become credit card debt-free.

Pay Off Debt in 7 Steps

Pay Off Debt in 7 Steps

Need solutions to pay down your debt and you don’t know where to start? Your answers are here.

Build Credit Without a Credit Card

Build Credit Without a Credit Card

Building your credit doesn't have to be with a credit card. Here's how you can do it.